Türkiye Household Inflation Expectations Survey (TEBA) is being published starting April 2024. Frequently asked questions about this initiative:

Why is measuring inflation expectations important?

Inflation expectations are a crucial leading indicator for understanding the dynamics of future economic activities. They play a critical role in asset pricing, policy decision-making, and the development of consumption and investment decisions. Companies set their product prices, employees engage in wage negotiations, and landlords determine rents based on these inflation expectations. Hence, today’s inflation expectations shape tomorrow’s actual inflation.

Even though inflation expectations in developed countries generally track close to the central banks’ targets, they still monitor these data very closely. They assess it from both the perspectives of market participants and households. In developing countries, however, the measurement of inflation expectations is quite lacking.

What's the situation like in Türkiye?

Türkiye has shown progressively worsening performance in meeting its inflation targets, especially after 2013, which has made it challenging to anchor inflation expectations. High forward-looking uncertainty makes it difficult to even roughly estimate where these expectations stand without proper measurement.

Meanwhile, inflation expectations are disclosed only through surveys conducted by the Central Bank of Türkiye and some major media outlets, focusing mostly on market participants. There’s no survey that measures and shares household inflation expectations data with the public consistently. The Consumer Sentiment Survey carried out by the Turkish Statistical Institute and the Central Bank attempts to address this but doesn’t share its results regularly. It was only after Fatih Karahan took over as the head of the Central Bank that these findings were shared with the public for the first time through an added box in the inflation report.[1]

What differentiates household inflation expectations from those of market participants?

Since Türkiye lacks publicly accessible data on household inflation expectations, we need to look at literature from countries where this data is available to answer this question. For instance, the University of Michigan has been measuring these expectations since 1978, and their survey is a well-regarded source used by the Federal Reserve, analysts, and the media. The New York Fed has also been conducting its independent survey for the last decade, while surveys like the Philadelphia Fed’s or the Blue Chip measure market participants’ expectations.

When comparing the two, household inflation expectations generally appear higher and more volatile than those of market participants. Households base their expectations on past inflation experiences, whereas market participants employ more sophisticated, forward-looking predictions. Studies show that household expectations are closer to what firms expect than those of market participants and have a stronger impact on consumption decisions, labor market supplies, and triggering wage-price spirals. This means household inflation expectations have a higher explanatory power for predicting actual inflation and its effects on the real economy.

From this perspective, we can argue that merely focusing on anchoring market participants’ expectations isn’t enough to measure the success of central banks in achieving inflation targets. It might be even more crucial to reach out to households, understand their expectations, and anchor them effectively.

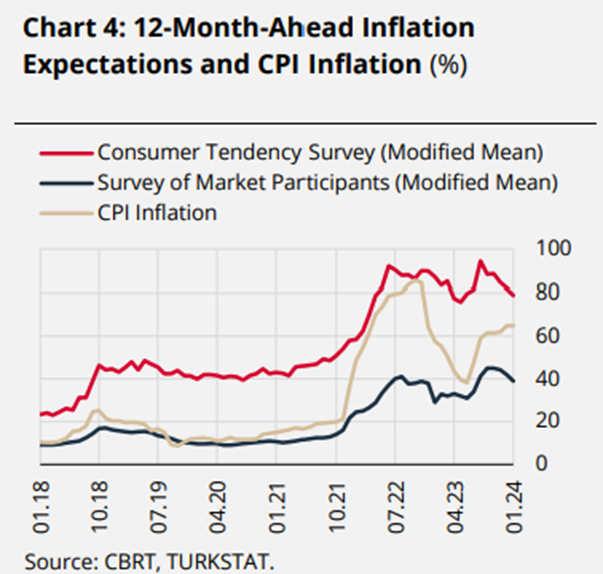

Despite the lack of public data on household inflation expectations in Türkiye, the chart provided below from Box 3.3 in the Inflation Report validate the general findings from abroad. For instance, as of January 2024, while market participants’ survey shows a 12-month forward inflation expectation of around 40%, this figure is about 80% for households. Our findings align with this range, and our latest survey results from the first quarter of 2024 indicate that the 12-month forward inflation expectation has risen further.

What challenges could arise from publicly disclosing this data in Türkiye?

We’re not measuring inflation; we’re dealing with forward-looking expectations, not creating an alternative to the monthly inflation figures released by the Turkish Statistical Institute. However, the dissatisfaction and confusion regarding the accuracy of the headline inflation figure could also affect how our survey is perceived. For instance, while the May inflation figure is announced by the Turkish Statistical Institute on May 3, 2024, our figure released on April 30 reflects the average annual inflation expectations of households for April, and for the end of 2024.

Will these survey results be shared with the public?

We started the survey in January 2024, and after a three-month pilot phase experimenting with various question styles, we are now ready to publish the survey results starting in April 2024. We plan to announce the results of Türkiye Household Inflation Expectations Survey (TEBA) on our website and share them on social media in the last week of the previous month, in alignment with the Turkish Statistical Institute’s schedule. Research shows that the more inflation is discussed in the media, the more it helps to update inflation expectations. We aim to create a dialogue and provide clear, scientifically validated information to assist in forming these expectations.